Samsung Money arrives to fight Apple Card: What you need to know

Samsung Money arrives to fight Apple tree Card: What you need to know

It seems every tech visitor these days, whether an established firm or startup, is pushing its own credit or debit card. Samsung joined the fray today (May 27) with a debit bill of fare of its ain, called Samsung Coin past SoFi.

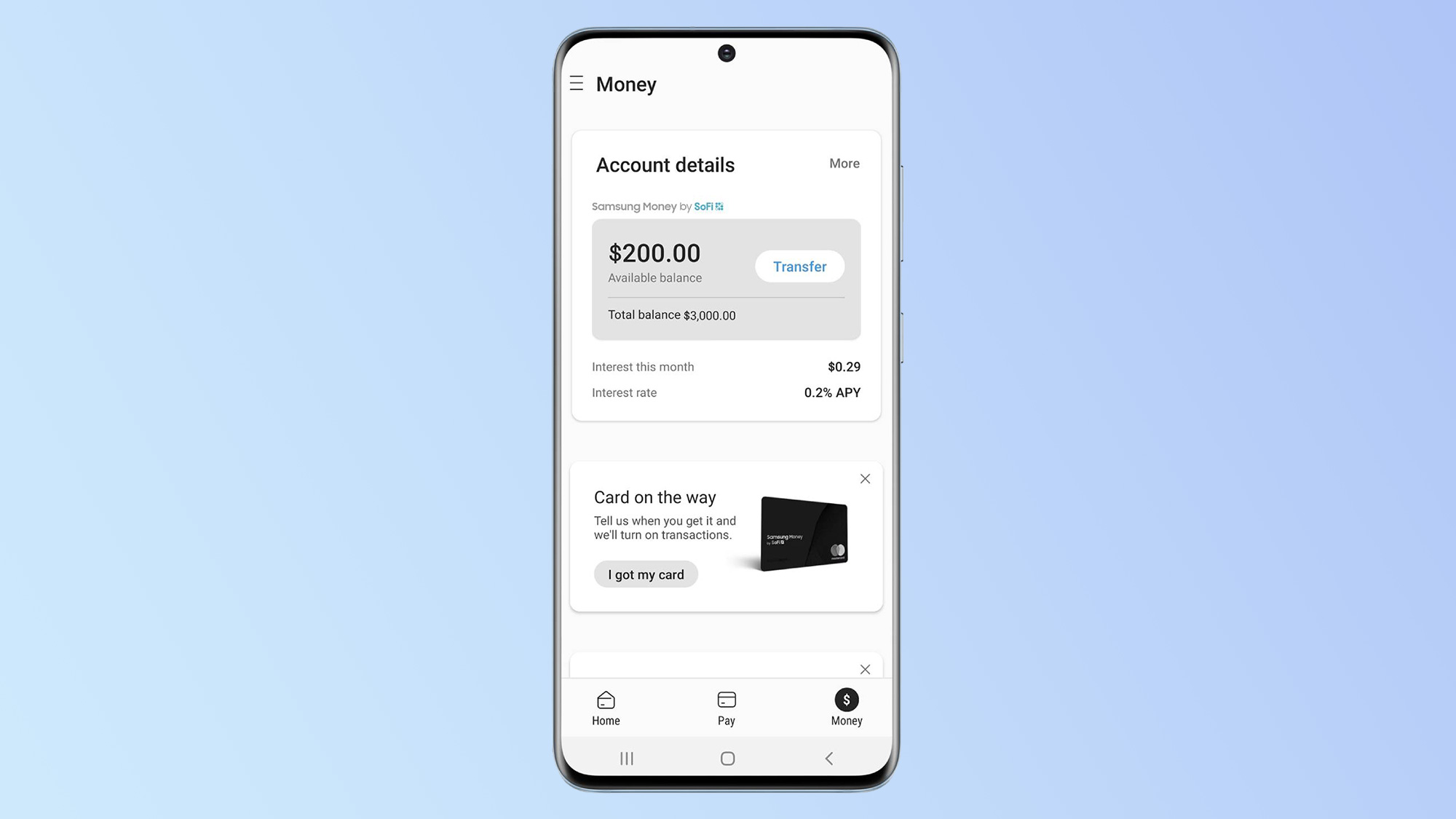

Unsurprisingly, Samsung Money plugs directly into the Samsung Pay app on the company's smartphones. From within Samsung Pay, you'll be able to effortlessly apply for a cash management business relationship and bill of fare. When your card arrives in the mail — information technology's issued by Mastercard — y'all'll even be able to activate it with a tap, rather than having to call a number.

- How to apply Apple tree Pay: Everything you demand to know

- Apple Pay vs. Samsung Pay vs. Google Pay: Which offers the all-time perks?

- Plus: Stimulus check two: 2nd round payment appointment, eligibility, status and news

In fact, the lack of an obligation to talk to a representative or use a clunky automated phone service to make business relationship changes is ane of the core themes of Samsung Coin. Flagging suspicious action, freezing or unfreezing your card and changing your Pin can all be washed right within the Samsung Pay app. That's unique, because some fiscal services don't grant customers the same kind of autonomy.

As you'd expect, spending perks are part of the equation every bit well. Connect your Samsung Pay account with a Samsung Rewards account, and you lot can earn points on each purchase you make, after flipping those points into discounts on Samsung products. Those points tin also be redeemed for cash.

On the carte itself, you won't detect a number, expiration date, or CVV lawmaking. All of that exclusively lives within the Samsung Pay app, where it'due south guarded by another grade of authentication, be it biometrics or a PIN code. Samsung Money accounts are FDIC insured for up to $one.5 1000000, which the company notes is "six times that of a normal bank account." Customers will likewise earn "college involvement relative to the national average," though Samsung doesn't get more than specific than that.

At that place's no business relationship fee associated with Samsung Money, though the fine print at the bottom of the press release states that's subject to change at whatsoever time. Whatsoever phone that already works with Samsung Pay will exist able to also employ Samsung Money, meaning you'll demand a Galaxy S6 or newer Samsung handset. Customers as well have access to a network of more 55,000 Allpoint ATMs, and won't exist reimbursed for fees incurred when using ATMs outside of that network.

Samsung Money is slated to launch later this summertime. Those interested tin join a waitlist and sign up for the latest updates through the Samsung Money website.

Source: https://www.tomsguide.com/news/samsung-money-arrives-to-fight-apple-card-what-you-need-to-know

Posted by: shieldsdinen1964.blogspot.com

0 Response to "Samsung Money arrives to fight Apple Card: What you need to know"

Post a Comment